With benefit levels from $2,500 to $17,500.

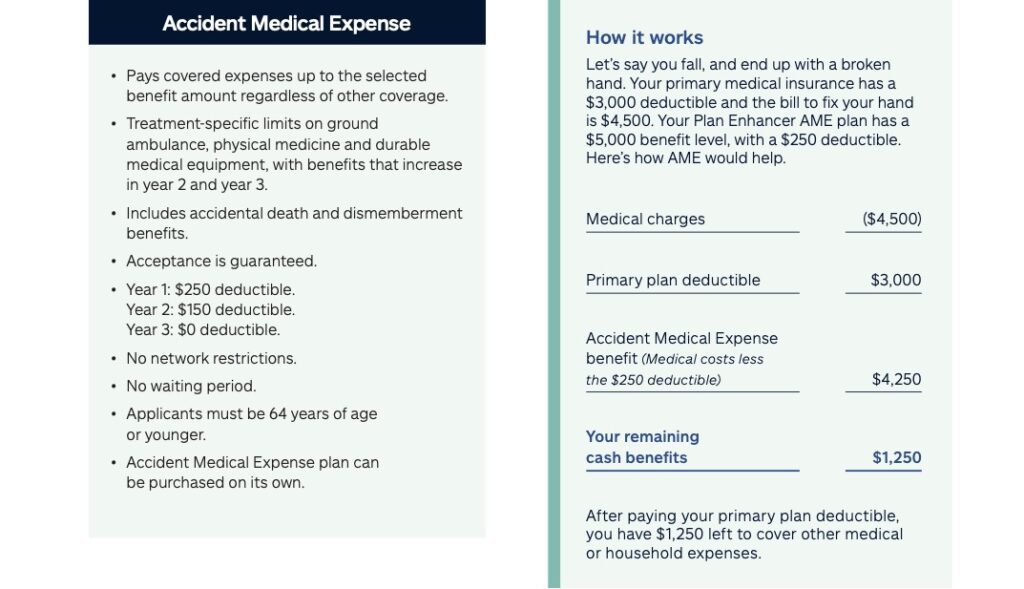

Start your plan with Accident Medical Expense coverage to pay accident-related health care costs and other expenses.

Add a Cancer and Heart/Stroke rider to receive lump-sum, cash benefits for a covered, first-ever cancer diagnosis and a covered heart attack or stroke

Add a Sickness Hospitalization rider to get lump-sum benefits for the first covered day of hospital admission due to a sickness.

ExcellentBased on 64 reviews

Eytan Ohayon7 February 2024Very smooth experience. Rudy is such a nice person that takes time to explain the different plans and bundled different insurance companies for my family to get the best protection. BEST prices !! YOU CAN'T GO WRONG. Keep up the great service.

Eytan Ohayon7 February 2024Very smooth experience. Rudy is such a nice person that takes time to explain the different plans and bundled different insurance companies for my family to get the best protection. BEST prices !! YOU CAN'T GO WRONG. Keep up the great service. Sandrine Boushira5 February 2024Bell and Lyons Insurance provides exceptional service for life and health insurance. Their team is attentive, knowledgeable, and truly cares about finding the best coverage for their clients. I highly recommend them for all your insurance needs.

Sandrine Boushira5 February 2024Bell and Lyons Insurance provides exceptional service for life and health insurance. Their team is attentive, knowledgeable, and truly cares about finding the best coverage for their clients. I highly recommend them for all your insurance needs. Shay H23 January 2024Made my insurance payments much cheaper, communication with the agent always great, definitely recommend

Shay H23 January 2024Made my insurance payments much cheaper, communication with the agent always great, definitely recommend Virginie Promeyrat16 January 2024Rudy was very efficient, everything is done fast!

Virginie Promeyrat16 January 2024Rudy was very efficient, everything is done fast! Lorena Boushira15 January 2024Rudy is very professional and took care of my health and life insurance and made the process very easy. He will get you the best plan customised for your needs. Highly recommend!!

Lorena Boushira15 January 2024Rudy is very professional and took care of my health and life insurance and made the process very easy. He will get you the best plan customised for your needs. Highly recommend!! Guy Manascu8 January 2024Got me the best deal for Insurance. They always available to answer my questions, highly recommended

Guy Manascu8 January 2024Got me the best deal for Insurance. They always available to answer my questions, highly recommended Nicky Antonelli8 January 2024They fantastic ✅👍

Nicky Antonelli8 January 2024They fantastic ✅👍 SANCHEZ Sandy4 January 2024Rudy est très réactif et professionnel. Il nous a très bien conseillé selon nos besoins tout en respectant notre budget. Je recommande.

SANCHEZ Sandy4 January 2024Rudy est très réactif et professionnel. Il nous a très bien conseillé selon nos besoins tout en respectant notre budget. Je recommande. pavel ruben31 December 2023Rudy was amazing and patient. Helped me with everything I asked . Highly recommended!

pavel ruben31 December 2023Rudy was amazing and patient. Helped me with everything I asked . Highly recommended!